home | galleries | videos | calendar of events | articles | feedback | about us

******

click on photo to enlarge

|

|

|

|

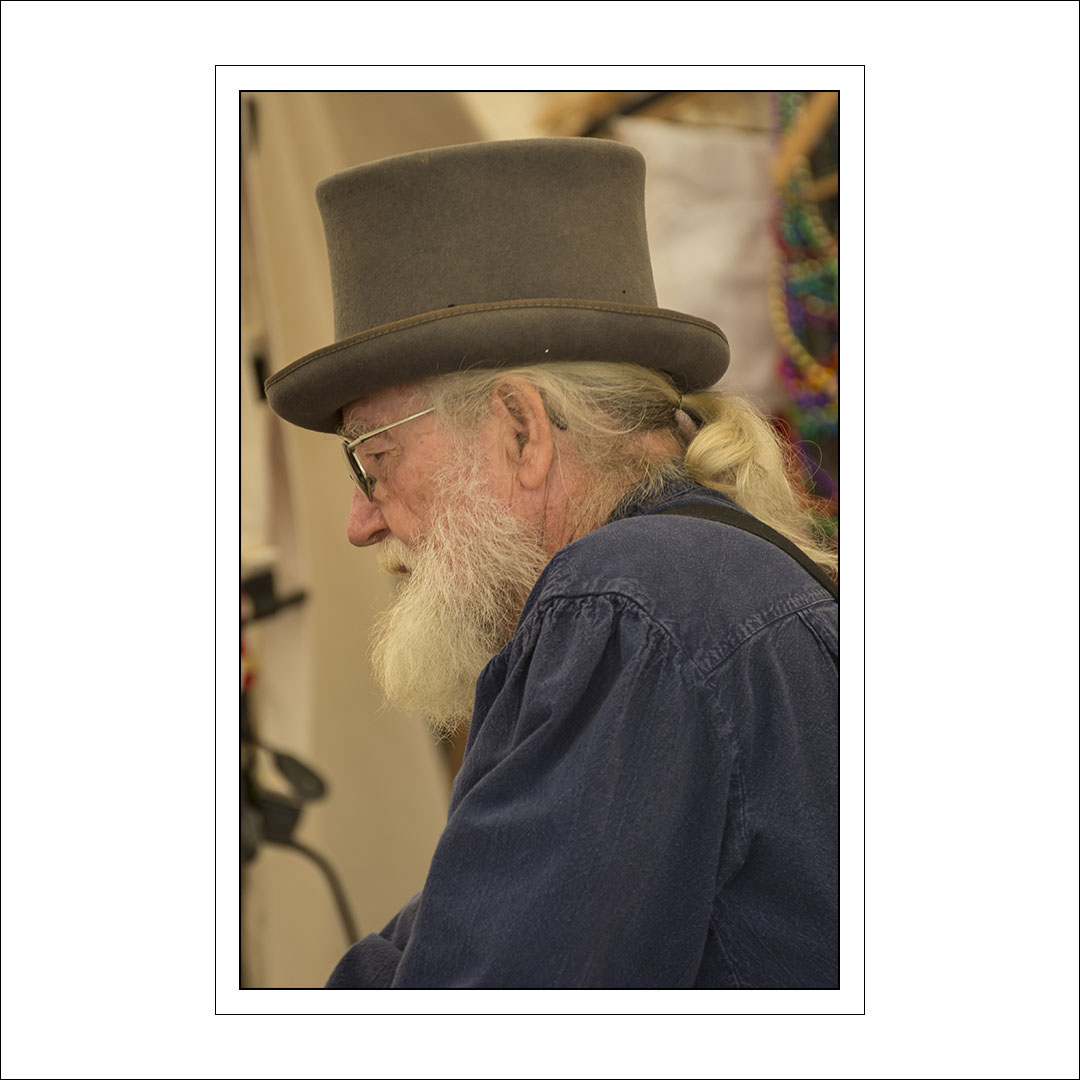

look22-154 |

|

|

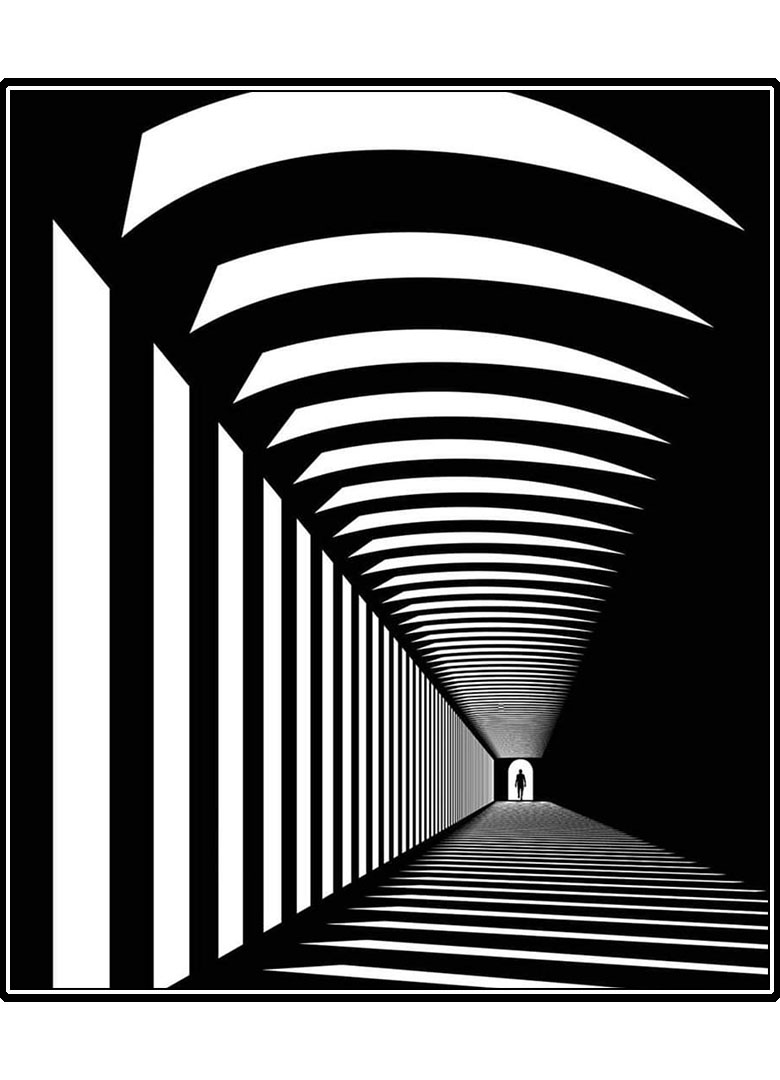

***Today's Lead Photo****

|

|

|

|

|

***Photo of the Day****

|

Welcome! |

|

click on an image below to go to gallery, video or article

****** insert? |

|||||||||||||||

|

|||||||||||||||

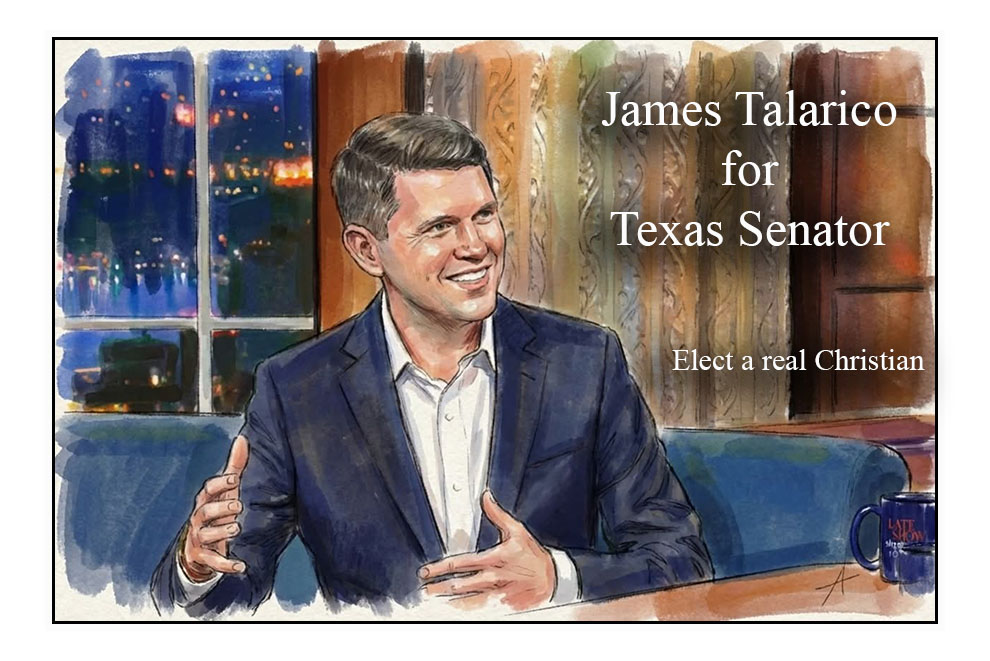

***Message for the Day****

random images -- click on the image to enlarge

|

|

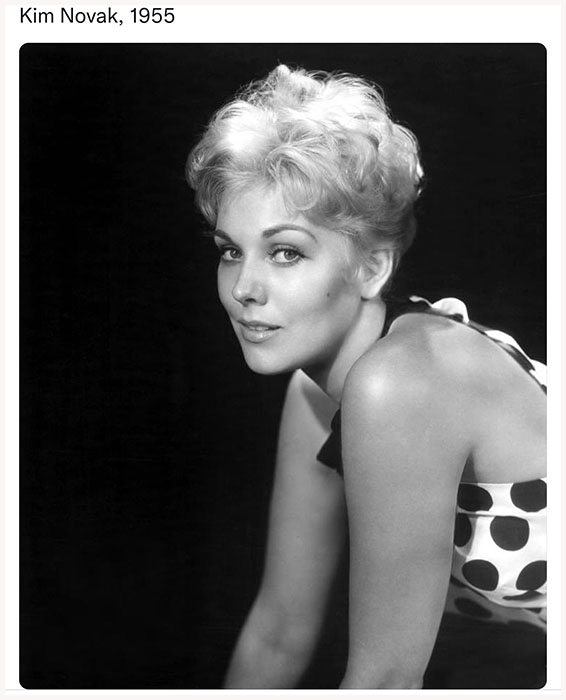

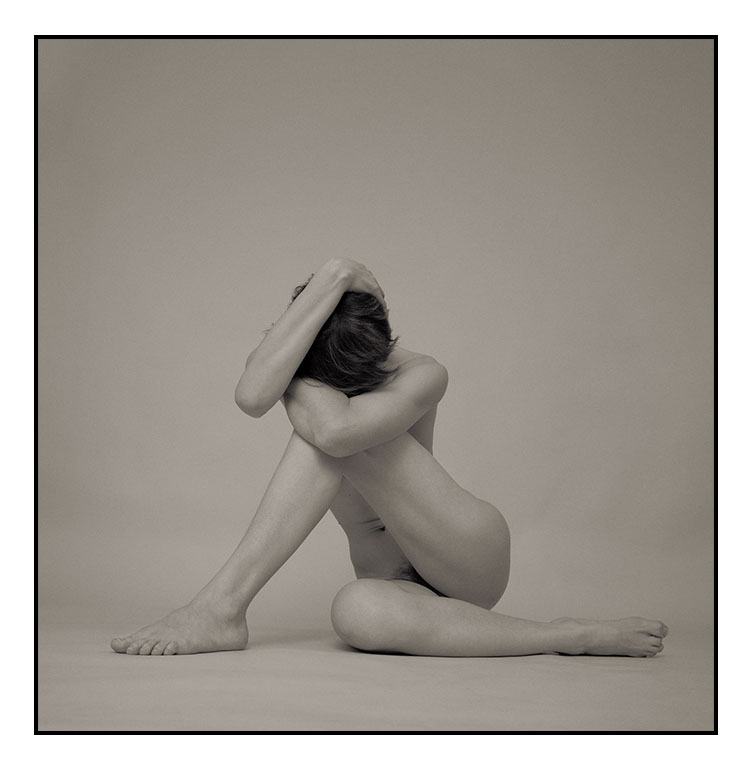

***Just Me - other photographers' work***

|

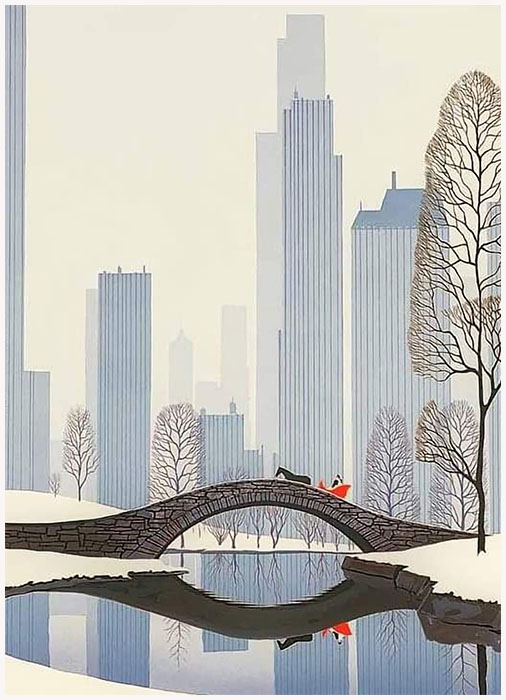

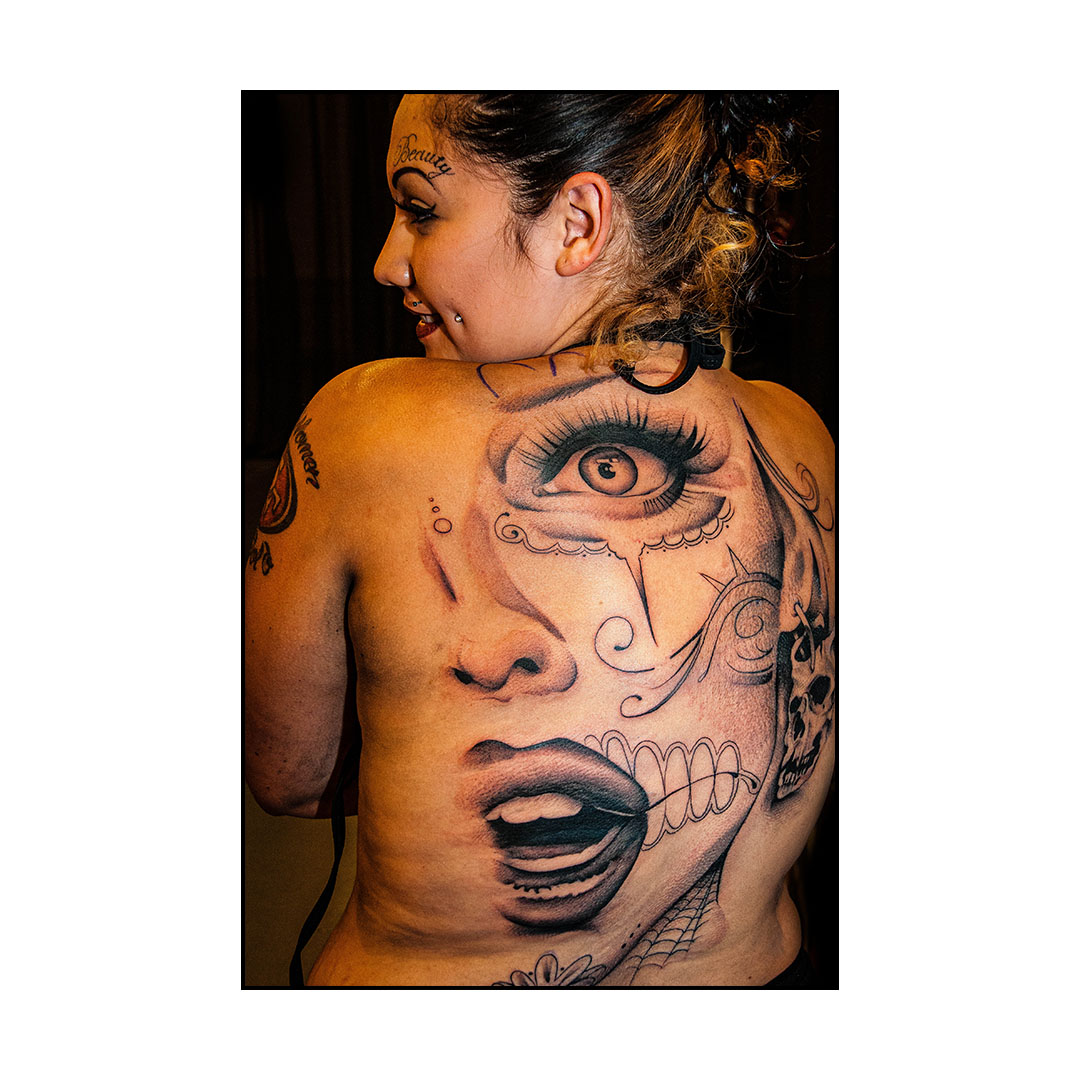

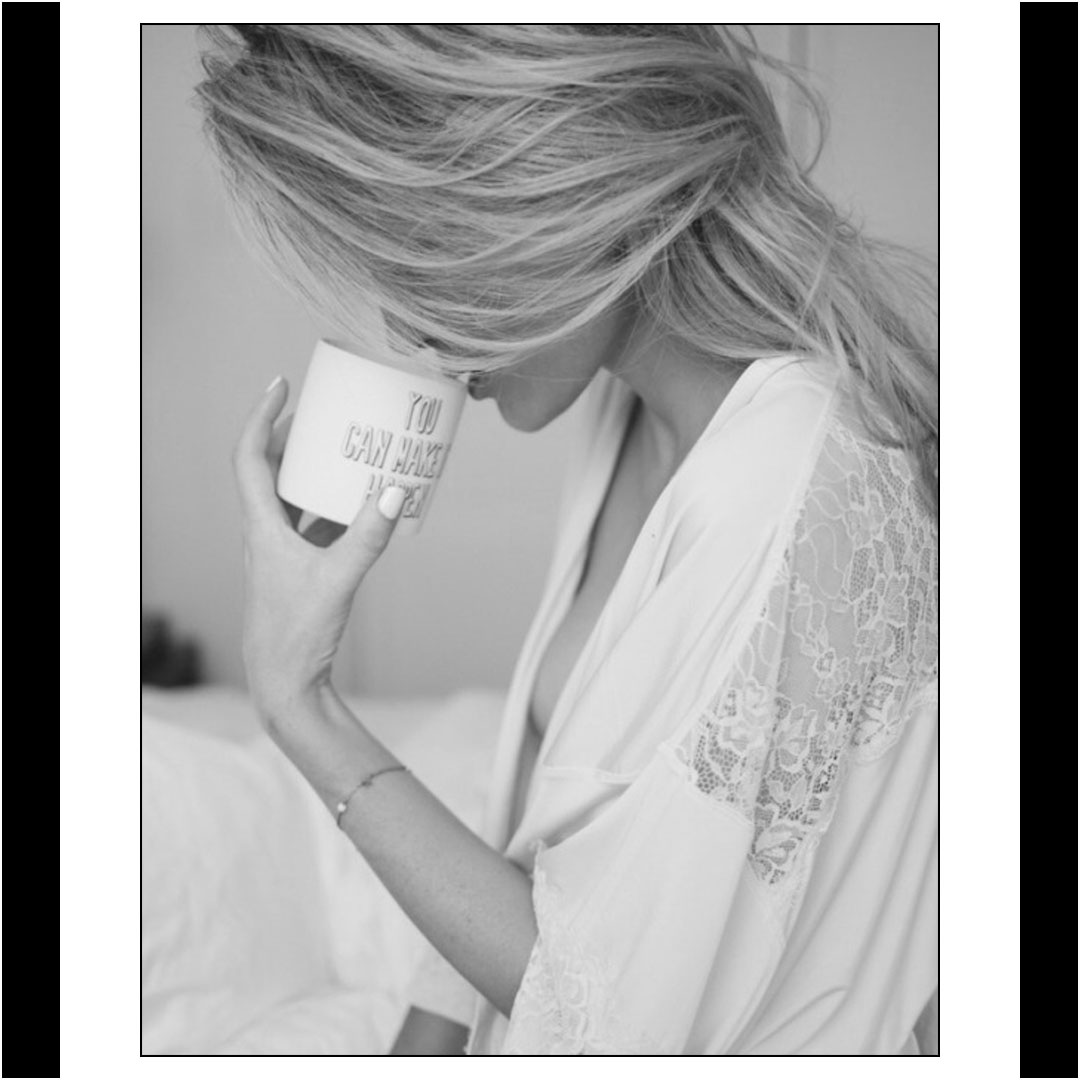

***The Coverup - other photographers' work***

|

***Last But Not Least****

home | contact us | show text | hide text