|

|

|

|

|

|

|

Morgan Stanley's explosive call on interest rates if Trump wins

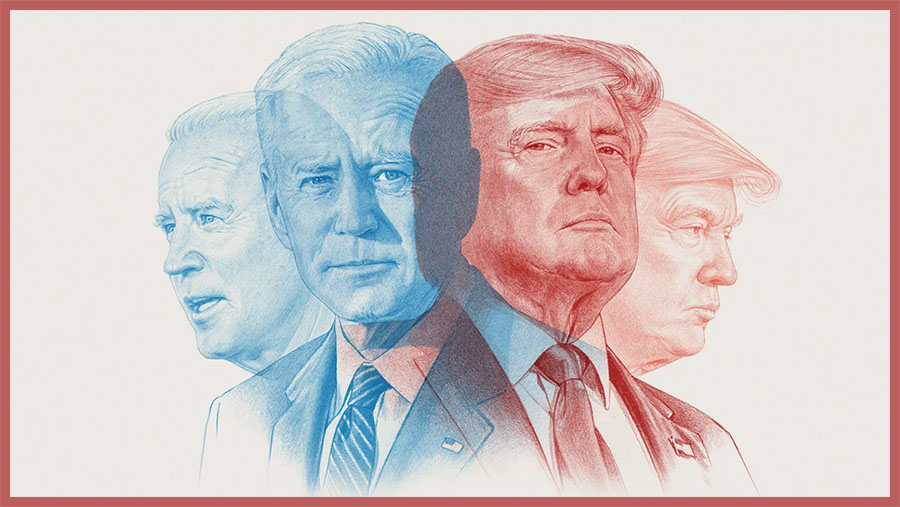

Story by Dan Weil After Joe Biden’s disastrous performance in last week’s presidential debate, the likelihood of a victory for Donald Trump seems to have increased markedly. If Trump does emerge victorious, one major question for the economy and your finances is: What will happen to interest rates? |

|

Morgan Stanley on the Trump effect So what does Trump mean for interest rates? Morgan Stanley strategists say it would likely mean lower short-term rates and higher long-term rates. That’s known as a steepening yield curve. “The sharp shift of probabilities in favor of President Trump may be a unique catalyst that makes curve steepeners attractive,” they wrote in a commentary cited by Bloomberg. They were referring to trades that would benefit from a steepening yield curve. One example would be to buy short-term bonds and sell long-term bonds. Slowing economic growth under Trump would push short-term rates down, as investors would expect the Fed to cut rates to fight the slowdown. And long-term rates would rise amid climbing inflation. Potential impact of deportations, higher tariffs Trump’s promise to keep new immigrants out and expel many of those who are here could dent the economy, Morgan Stanley's analysts said. That’s because their presence has helped employers find the workers they need, giving the economy a boost. His pledge to ratchet tariffs higher also could dent the economy by making it more expensive for manufacturers to produce their goods. Higher tariffs also are inflationary, as they push up prices for the goods with tariffs. That would tend to push long-term rates higher. trump240702 |

|

... ... |