home | what's new | photos of the day | galleries | videos | calendar of events | articles | feedback | about us

|

Currently on the page |

|

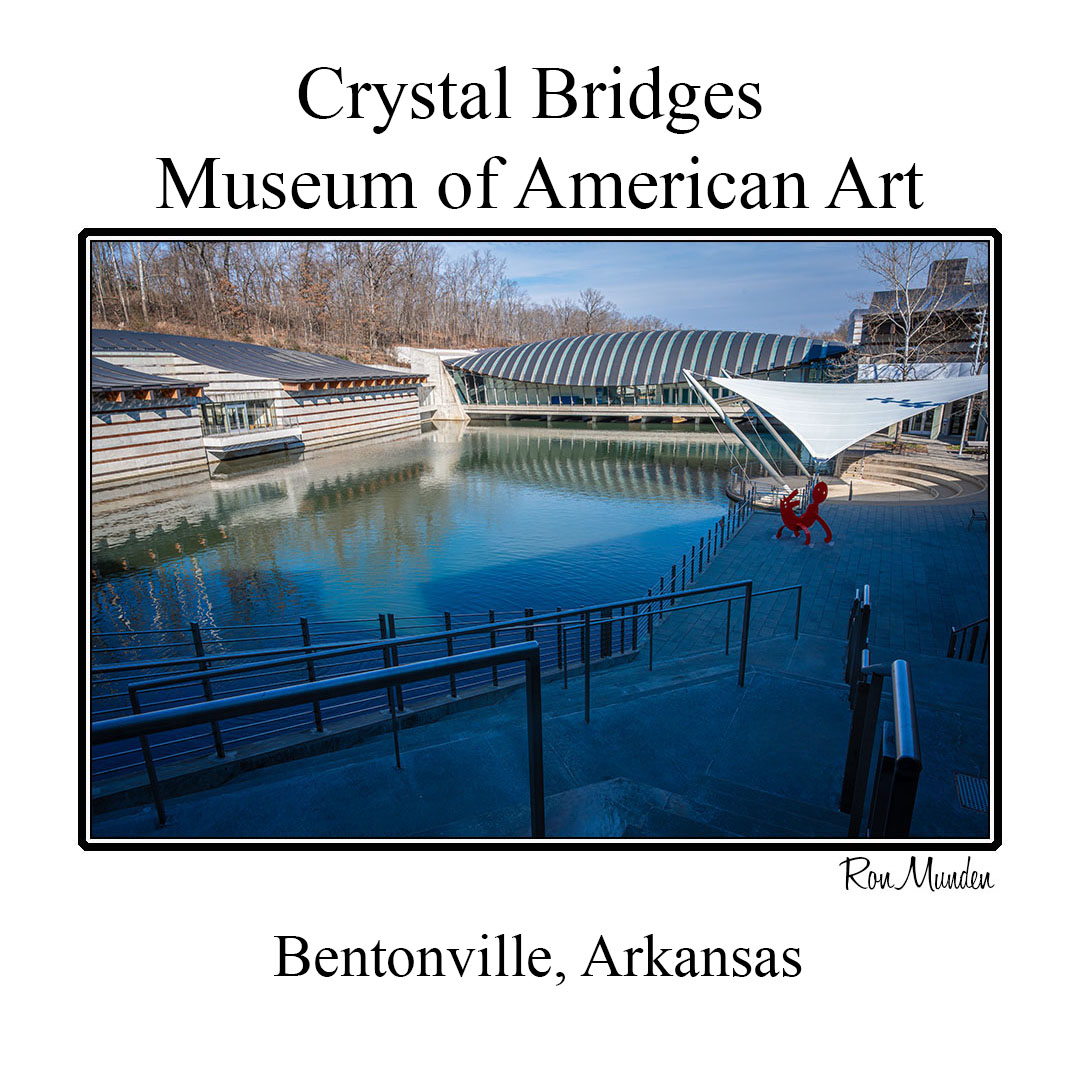

click on image below to go to gallery or article*

|

|

|

|

|

wesee22-168 |

|

|

Featured Gallery

Visit our Social Media Accounts

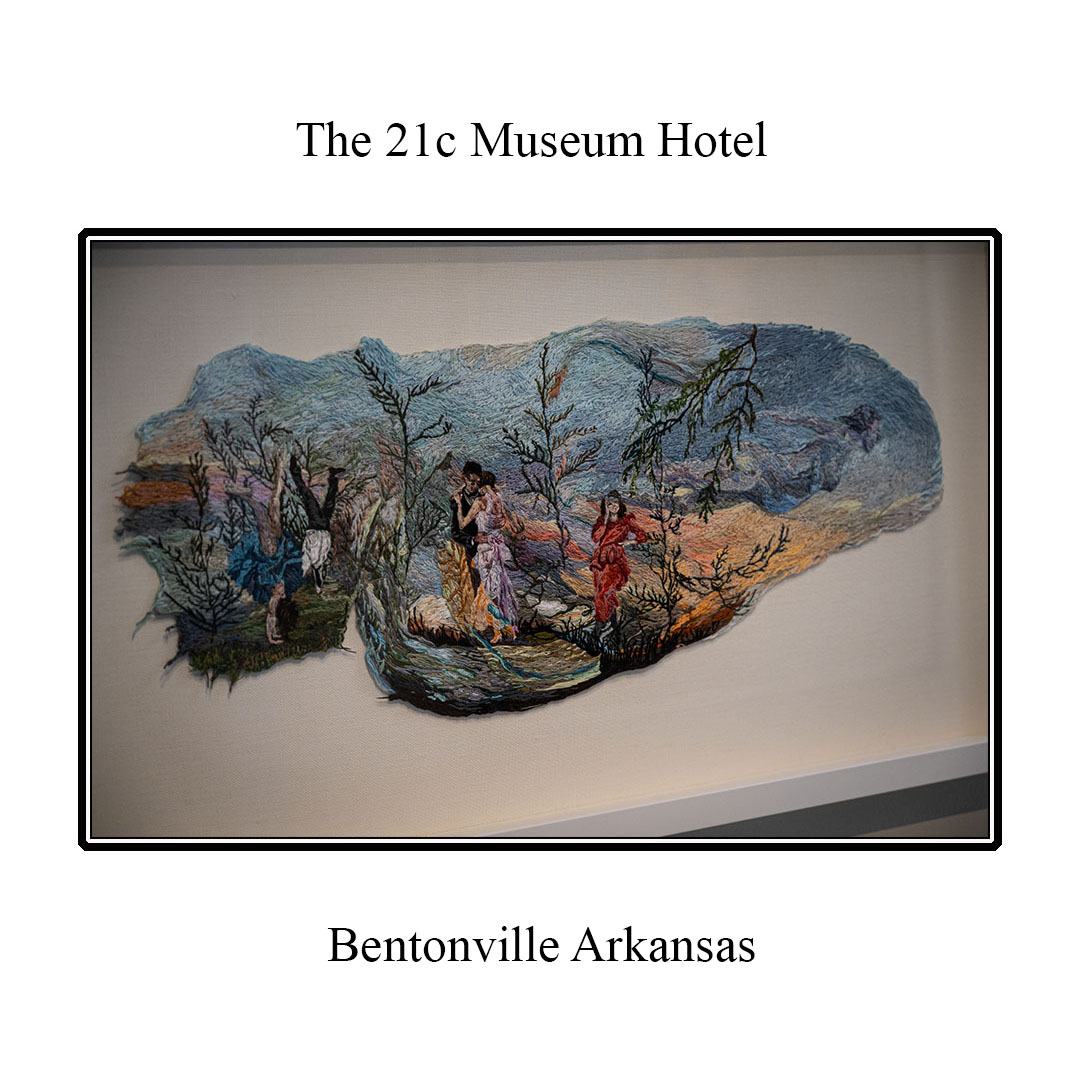

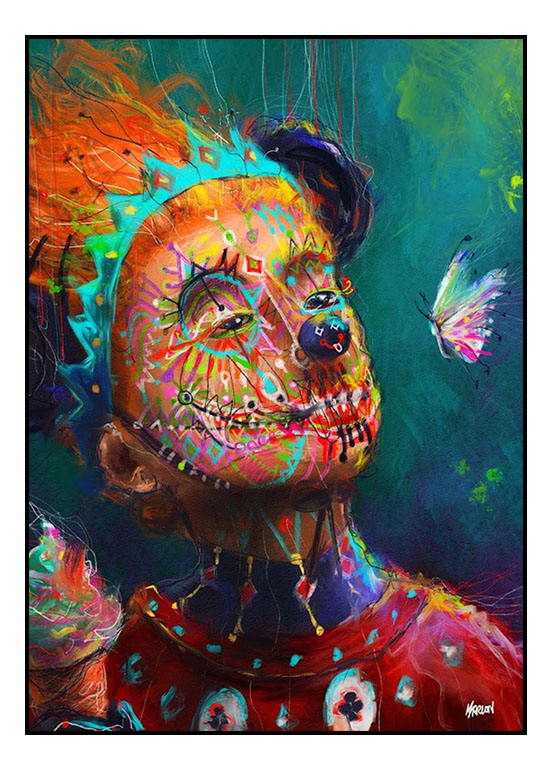

***Art Corner -- featuring Other Peoples Work***

*Blended photo -- click on image to enlarge

***Abstract Images -- featuring Other Photographers Work***

***From My Body Of Work***

For more random photos from the Photographer's Selection click below

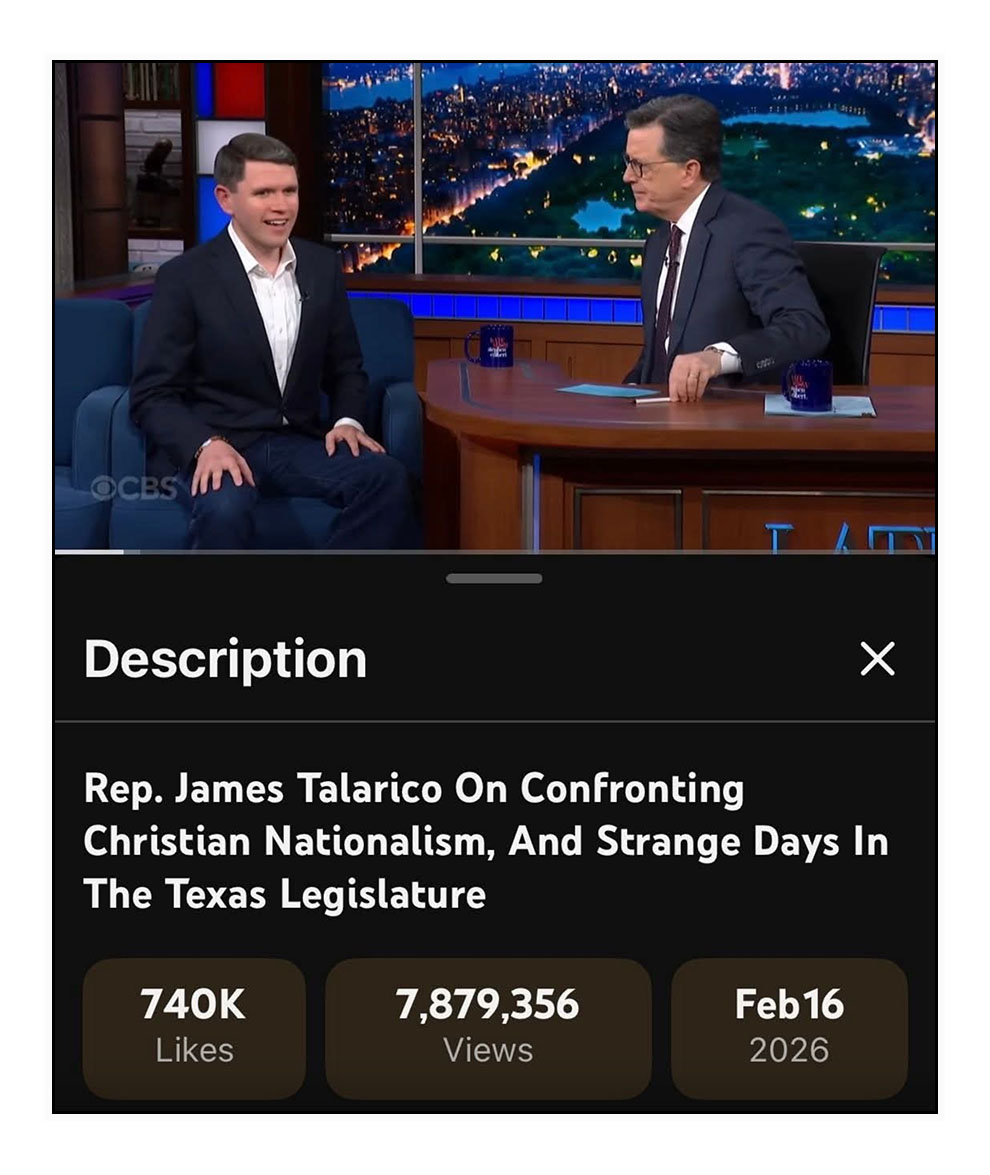

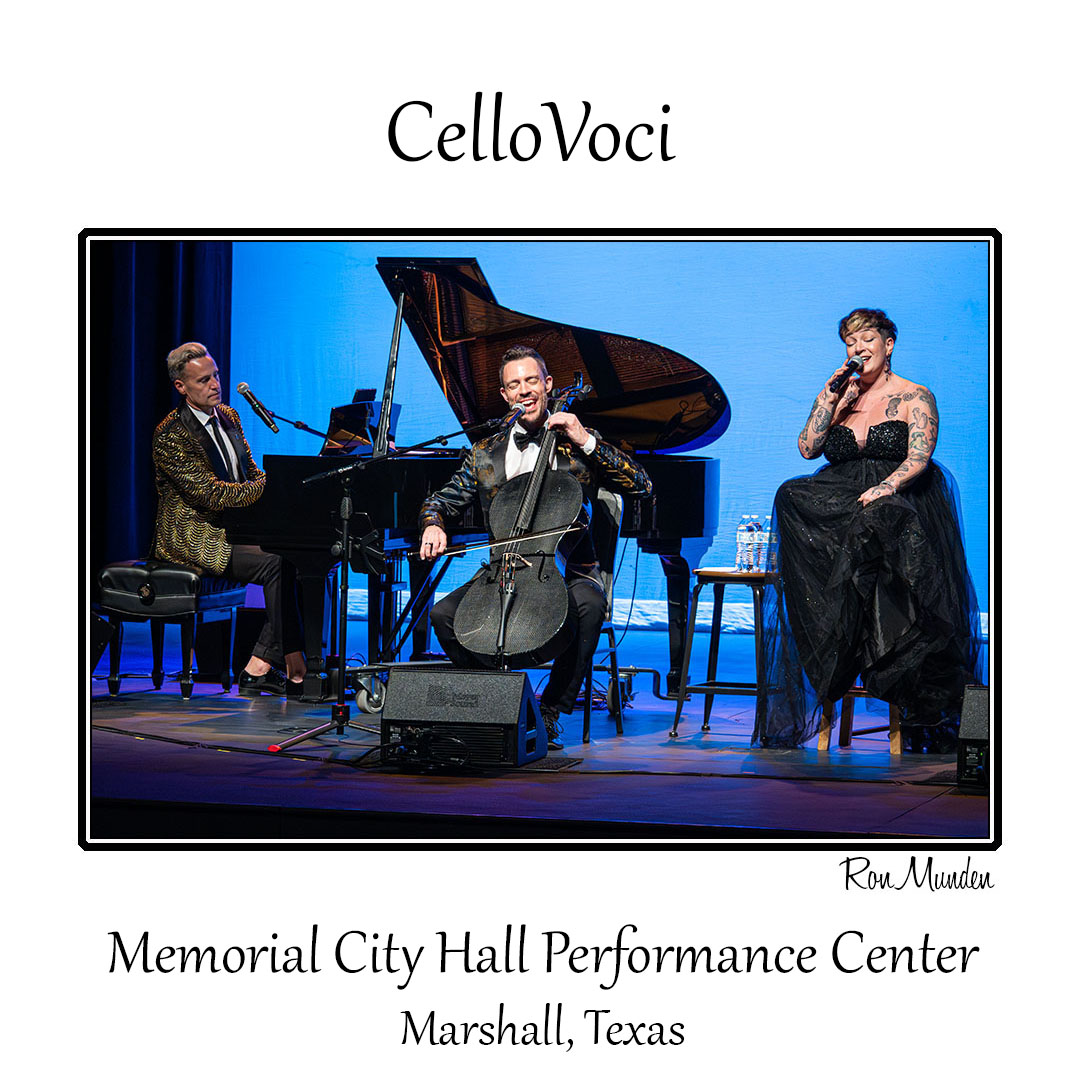

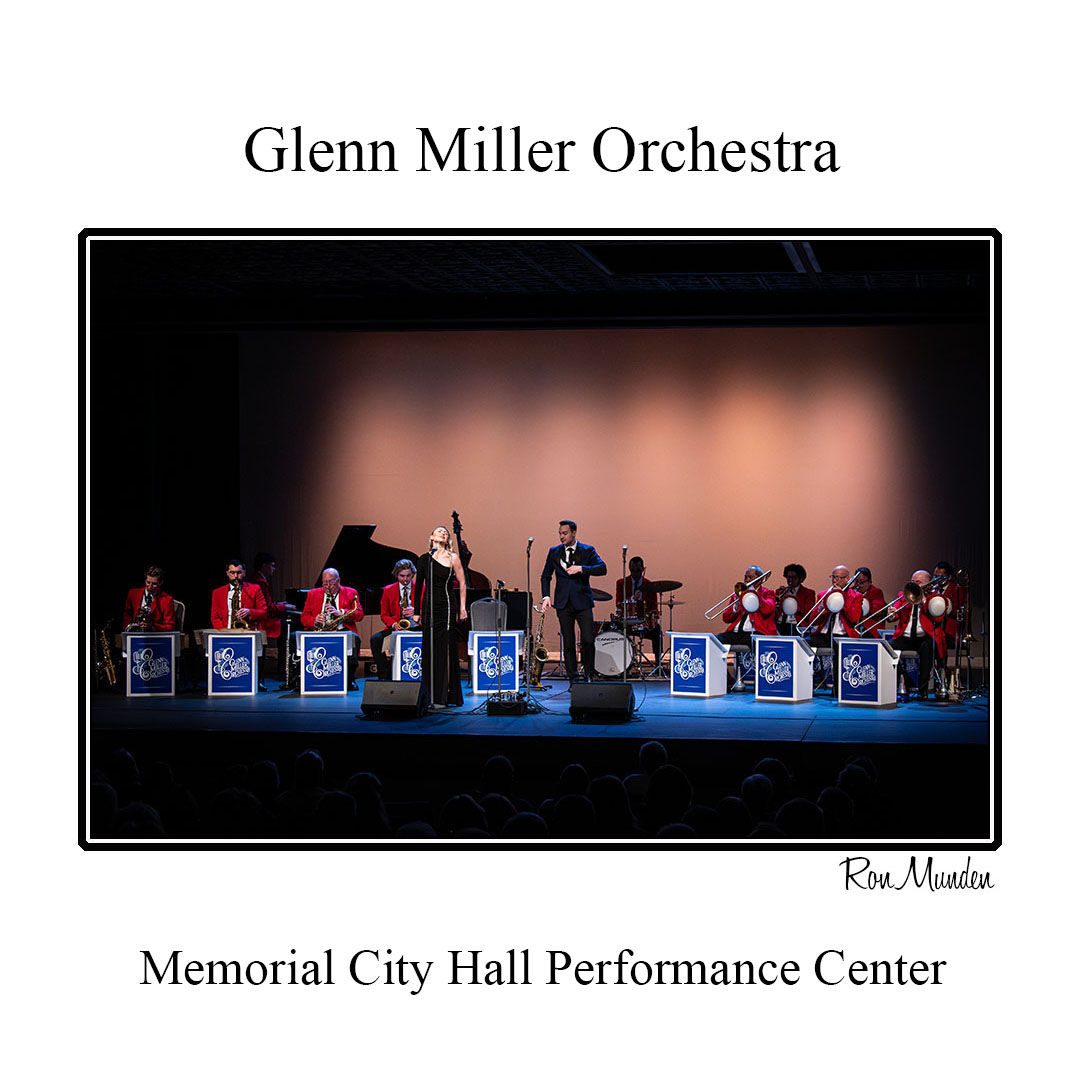

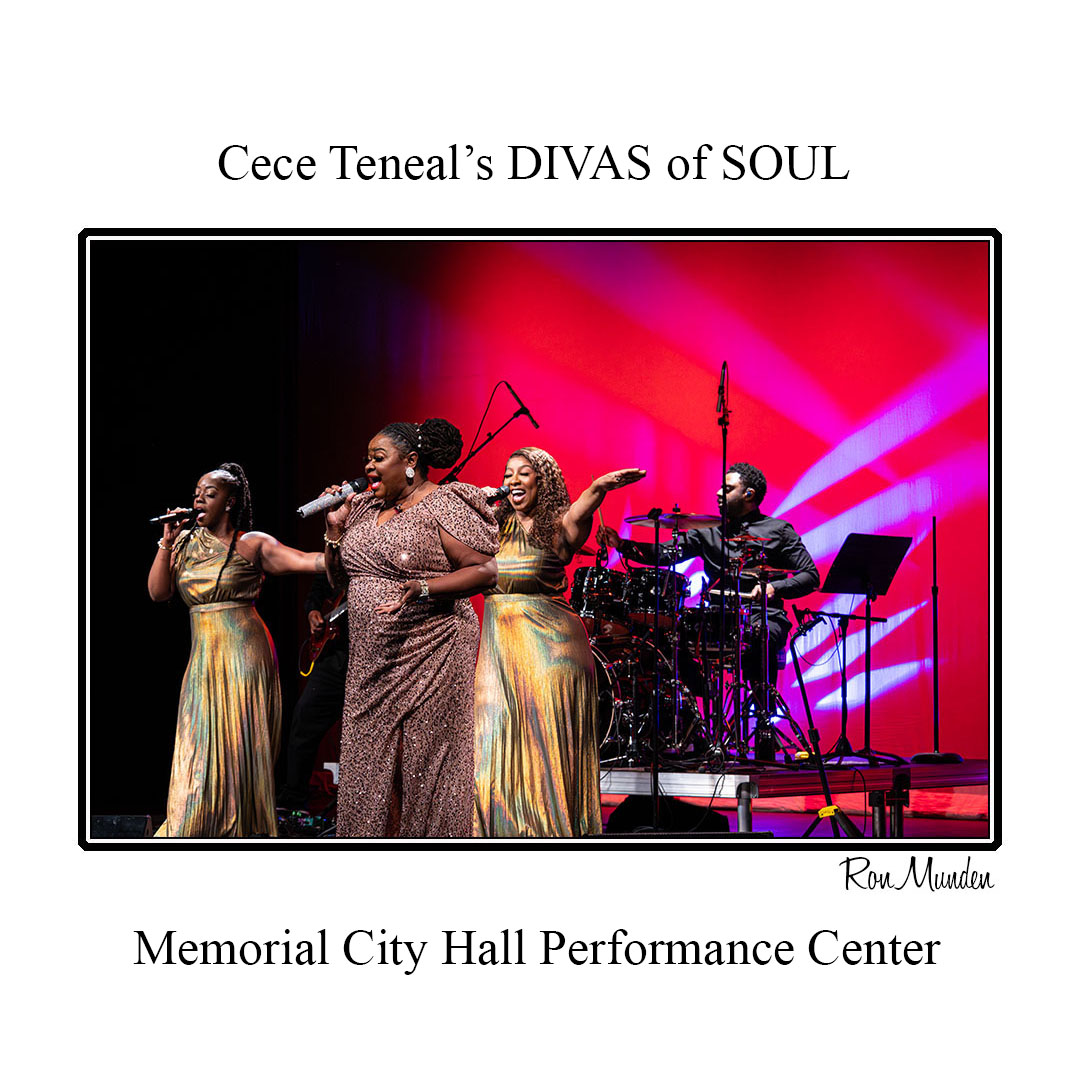

***Picture of the Day -- PEOPLE ***

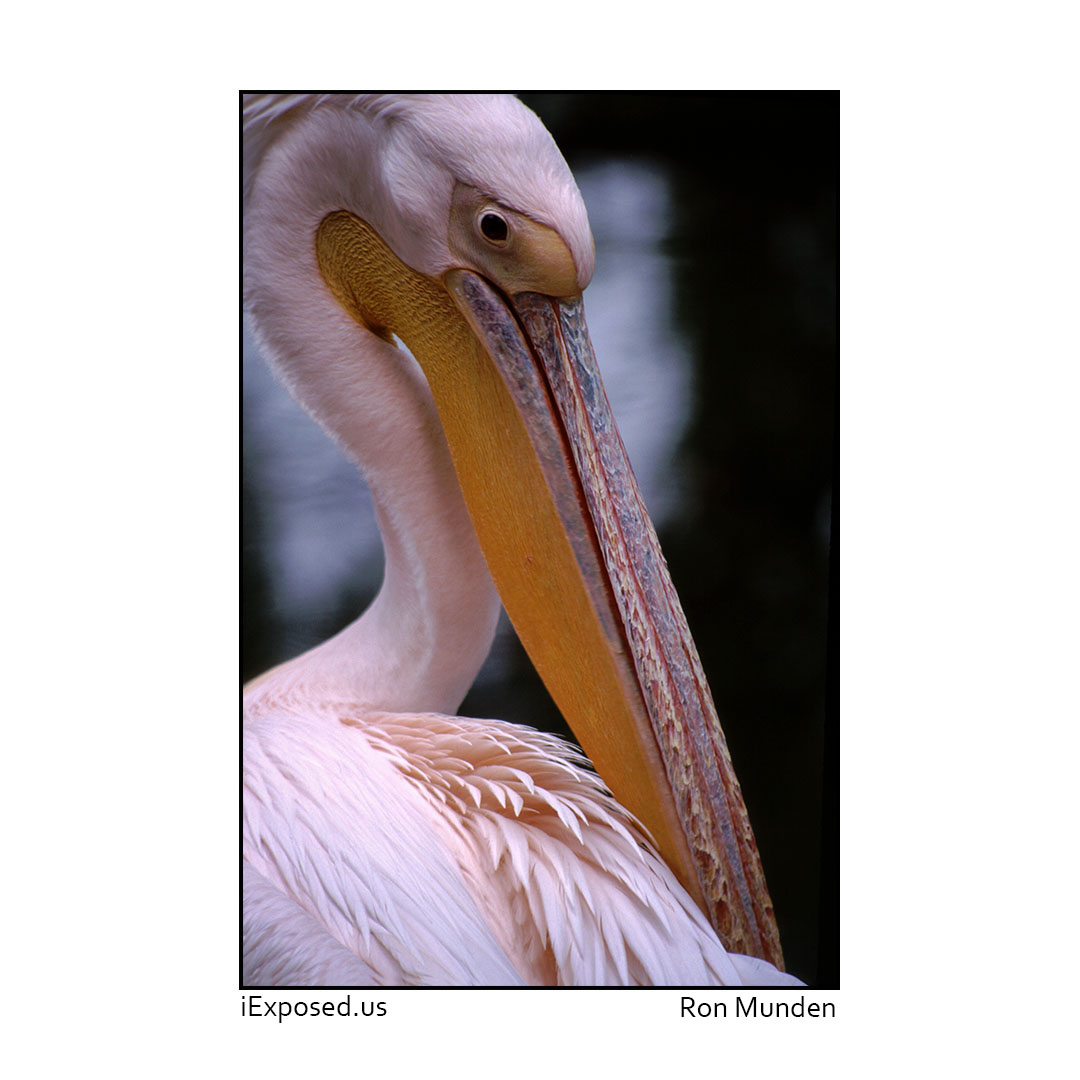

***Picture of the Day -- ODDBALL *** ***Picture of the Day -- NATURE *** |

|

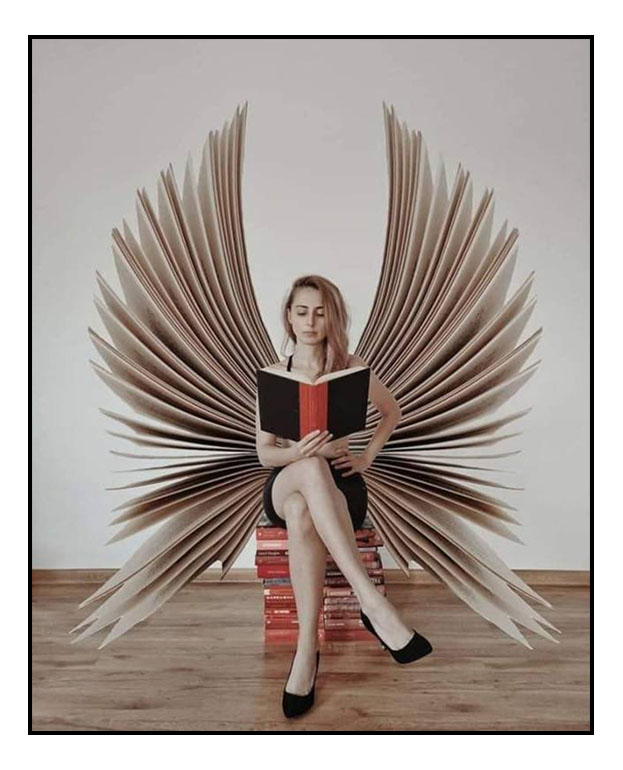

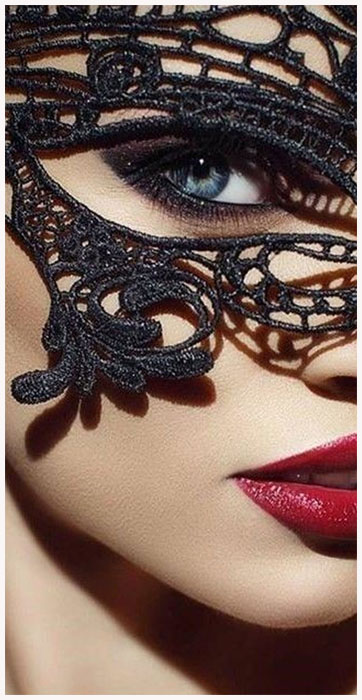

*****People - other photographers' work***

|

***Fine Art Photography - other photographers' work***

|

|

*****The Naturists - other photographers' work***

|

***Creative Photography - other photographers' work***

|

Give us your Feedback about this Website

Click here to visit out sister website

home | contact us | show text | hide text